RECENT NEWS

2023

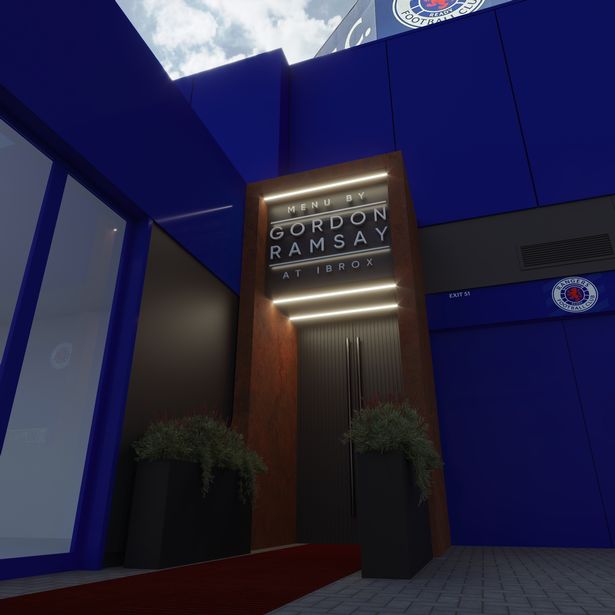

ACRS Capital is an equity partner in the Blue Marlin London, located at the famous Mondrian Hotel owned by the Reuben Brothers.

The 20,000 sqft Blue Marlin is set to be one of London’s most exclusive celebrity haunts and premier members’ clubs housing two restaurants, three bars, a nightclub, roof terrace, pool, spa, gym, co-working space and an atrium patio space.

The Blue Marlin London will open in September 2023.

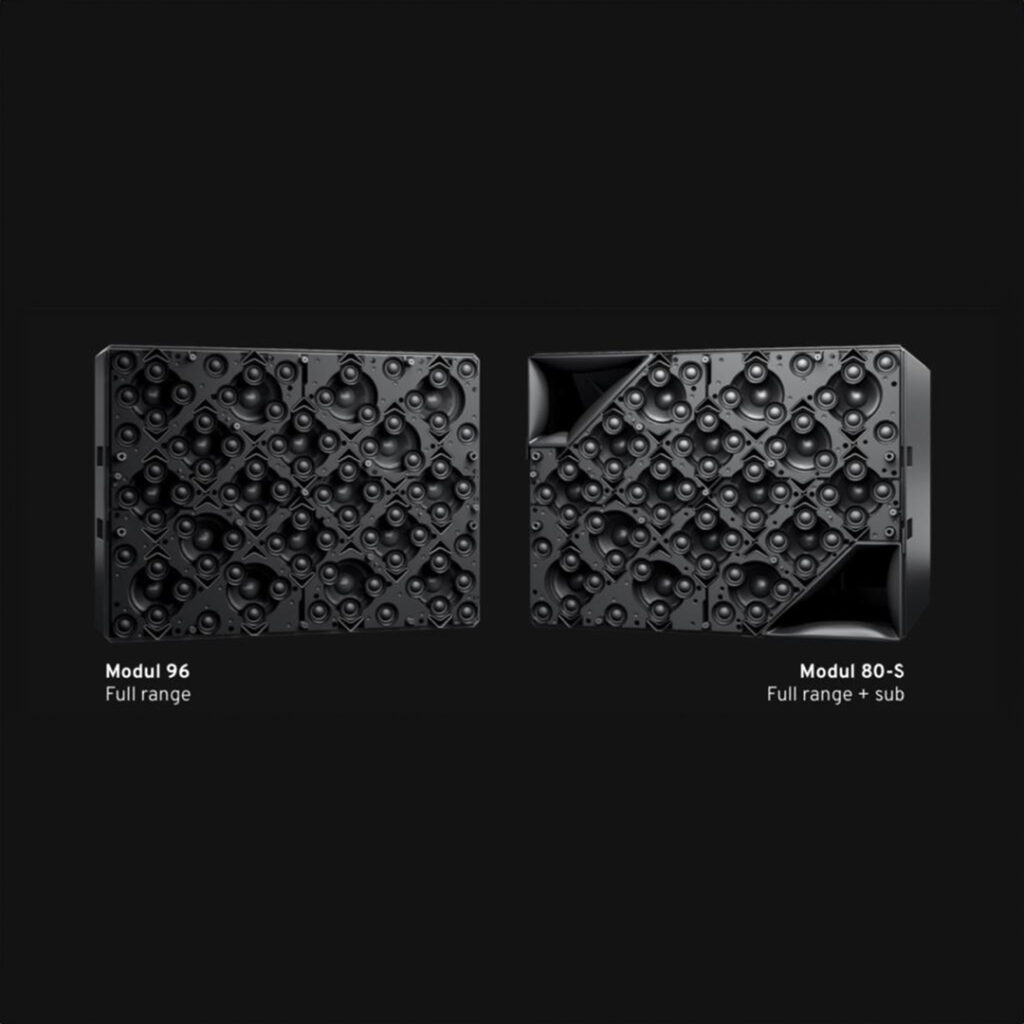

ACRS Capital has been mandated by multi award winning Berlin based audio technology hardware and software company Holoplot to assist in a substantial fundraise to provide aggressive expansion capital to this truly disruptive beam technology which enables sound to be controlled like light.

Holoplot has been selected to be the audio partner for Las Vegas’ iconic and ground breaking SPHERE and is rolling out its X1 product range globally in some of the worlds most exciting spaces including concert venues, airports, train stations, large houses of worship, hotels and translation based conference venues.

For more information please visit www.holoplot.com

2021

ACRS Capital is the co-founder the lead investor in Spey Soda drinks company, a consortium between ACRS Capital, Highland Spring Mineral Water, 1:9:90 Holdings and a major UAE family.

Spey Soda is a luxury range of flavored carbonated mixers and premium water sourced from Scotland’s iconic River Spey, home of Scotland’s best whiskeys.

The range of flavors were curated by one of the whiskey worlds’ most respected figures and the former master blender at the Macallan, it is positioned as the perfect accompaniment to premium whiskey and whiskey based cocktails and mixed drinks.

A predicted popularity surge in whiskey and whiskey based drinks has garnered Spey Soda a current valuation of £20 million as it prepares for its next fundraising round.

For more information see www.speysoda.com

ACRS Capital is the exclusive agent for Caprice Holdings in the United Arab Emirates. Richard Caring’s Qatari-backed hospitality group portfolio includes: The Ivy, Harry’s Bar, The Ivy Asia, Scott’s, Sexy Fish, Daphne’s, Balthazar, J Sheekey, The Atlantic Bar, Dolce Vita, The Granary Square Brasserie, 34 Mayfair, and Urban Caprice for high end catering and pop up events, amongst others.

Selected brands in the portfolio will be rolled out in the Gulf region this year.

Exclusive agent and franchise owner of Speyside’s iconic Quaich Whiskey Bars for GCC region. Openings to be announced soon.

Acrs Capital is the exclusive agent and franchise owner of Mahiki Night Clubs and Mahiki Beach Clubs for the GCC region and holds a profit share agreement with Mahiki Rum on sales of Mahiki products and Mahiki@home party packs in the GCC region.

2020

Investment raised from a leading European real estate firm of EUR 20 million hotel investment comprising of a land purchase and committed capital to construct a 45 room new build hotel on the island of Ibiza, Spain.

Secured 25 year management contract for a major international lifestyle brand and hotel operator to manage a boutique 50 room 5* hotel on the island of Mykonos, Greece.

Provided consultancy services to a leading British entrepreneur to develop a strategy for the roll out of E1 Brew Co beer and associated freehold brewery venue in Shoreditch, East London.

2019

Development of strategy on behalf of the Mayor of

Nur-sultan in Kazakhstan to invest in and develop leisure related real estate and entertainment assets and to advise on how to grow the Republic of Kazakhstan’s leisure and entertainment night-time economy.

Investment raised from a European Family office of EUR 18.5 million for the sale and leaseback (25 years) of one of the most iconic and well-known hotels in the ‘Pacha area’ on the island of Ibiza, Spain.

Topping-out ceremony to mark the completion of China Xinxing Group Company Limited (CXXG) portion of the Kazakhstan leg of Belt and Road project, NurKazkahstan. The total CXXG construction contract value was US$985 million, financed by China EXIM Bank for the KM (415km) MB (266km) and SWBA (33km) roads, thus earning ACRS Capital a significant TCV % related success fee. As thanks and recognition, the original founder of ACRS was awarded the President’s Medal from President Nursultan Nazerbayev, the highest accolade possible to obtain in Kazakhstan – equivalent to a peerage in the UK.

ACRS Capital provided comprehensive transaction consultancy services to Shoreditch Bar Group (SBG) in their £50 million private equity style cash acquisition of Novus Leisure consisting of an estate of several large high capacity prime West End leisure locations and venues in major city centers across the UK, anchored by their iconic Tiger Tiger Brand with its flagship venue on London’s Haymarket off Piccadilly circus.

2018

ACRS Capital successfully raised equity (undisclosed sum) from a European family office to enter into a partnership with the Espiritu Santu banking family to co-invest in the development of a new construction project consisting of a luxury 5* boutique hotel and accompanying villa residences in Comporta, Portugal located less than 1hr’s drive from Lisbon.

2017

ACRS Capital, working with senior figures in the Republic of Cuba, signed a consultancy agreement with China Railway Construction Company (CRCC), the world’s second-largest construction company, to assist CRCC in making high-level introductions in the Republic of Cuba in order to facilitate CRCC in winning construction and infrastructure contracts from the Cuban Ministry of Construction as part of China’s Belt and Road Project.

2016

Through its high-level Chinese contacts, ACRS Capital signed a consultancy agreement with China Xinxing Group Company Limited (CXXG), to assist them in making high-level introductions in the Republic Kazakhstan in order for CXXG to win construction contracts from Kazavtozhol under the Kazakhstan Ministry of Transport as part of the Belt and Road Project with a total available construction contract value of US$3.5 billion.

2015

ACRS Capital assisted Samena Capital in raising a significant investment from a leading member of the Al Nahyan family as part of a US$235 million investment in the UAE-based RAK Ceramics, the largest ceramic producer in the world.

2014<

Prior to 2014, ACRS Limited (as it then was) provided consultancy and introductory services for large blue-chip clients such as, amongst others, Nokia and General Electric assisting them in winning projects in the Gulf and Asia.

ACRS Captial LLC

International Free Zone Authority

Dubai Silicon Oasis

Dubai

United Arab Emirates

Office +44(0) 208 133 1982

UAE +971(0) 551 69 60 31

info@acrscapital.com

© 2018-2020 ACRS | Capital. All rights reserved.

By using this site you accept the TERMS OF USE